As an expat in Germany there is no restriction on your right to purchase property. For a mortgage, non-residents can generally borrow up to 55-60% of the property value. Official residents in Germany can borrow up to 80%.

The most common type of mortgage in Germany is a fixed interest loan (Annuitätendarlehen). It has a constant interest rate for a fixed period of time, generally between 5 to 30 years, with 10 years being the most common. At the end of the fixed payment period, the outstanding amount must be paid in full, or you can refinance with a new mortgage. During the term you can reduce the principle by up to 10% of the outstanding balance each year with additional payments (Sondertilgung).

There are other types of mortgages available, such as interest-only and variable rate: find out more here.

To find out how much you can borrow, use a mortgage calculator or enquire at local banks. The main factors which are taken into account by lenders are personal background, income and job status. Using a broker can help you find the best mortgage deal by taking into account your situation and their knowledge of what is on offer from different banks; they will also guide you through the mortgage application process.

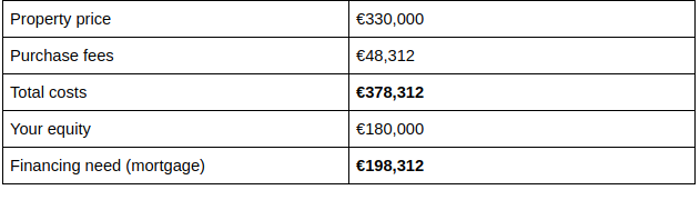

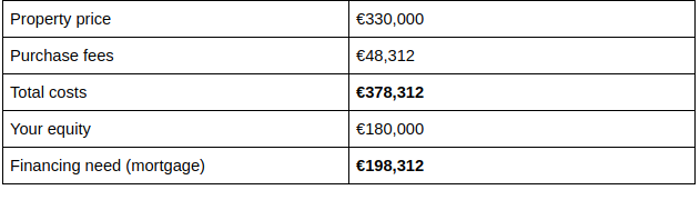

You first need to determine how much capital (your equity) you have available. Then add 10-15% on top of the purchase price for a property to cover taxes and fees (the amount depends on where the property is located). Taxes and fees include:

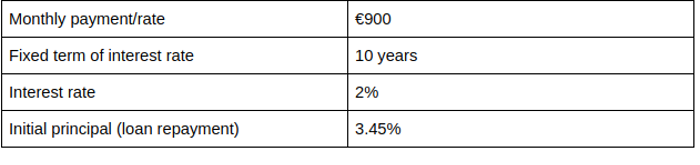

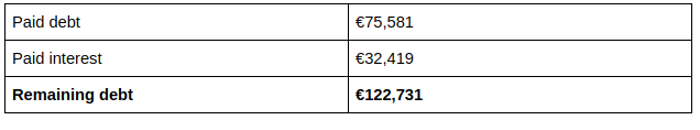

The next step is to review your income and spendings and decide what credit rate you can afford each month. Let’s say you are comfortable contributing €900 per month and are granted a 10 year loan with a fixed interest rate of 2%, paying off the debt with 3.45%. The monthly payment of €900 remains constant, with the interest portion decreasing and the loan repayment increasing over time.

After 10 years, you would then have to pay the remaining amount of €122,731 or refinance with another mortgage. Put your own figures into a mortgage calculator to get a quick answer.